inheritance tax rate in michigan

Heres a breakdown of each states inheritance tax rate ranges. Inheritance tax may also apply to life insurance death benefits.

Michigan Inheritance Laws What You Should Know Smartasset

Estate tax of 108 percent to 12 percent on estates above 71 million District of Columbia.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

. Michigan does not have an inheritance tax. The michigan department of revenue is responsible for publishing the. Its applied to an estate if the deceased passed on or before Sept.

Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. Mom recently passed and left an IRA with me listed as beneficiary. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

The only death tax for Michigan residents is the federal. Inheritance Tax Rate In Michigan. In 2018 the Federal Estate Tax Exemption was increased under the Tax Cut and Jobs Act.

The top estate tax rate is 16 percent exemption threshold. It only counts for people who receive. Mom had opted to have.

Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St. Michigan does not have an inheritance tax with one notable exception. The state of Michigan levies no inheritance tax or estate tax as of 2015 reports the Michigan Department of Treasury.

Its applied to an estate if the deceased passed on or before Sept. Michigans estate tax is not operative as a result of changes in federal law. All other beneficiaries will pay an inheritance tax rate of 18 with the first 10000 of value exempt from taxation.

The Michigan inheritance tax was eliminated in 1993. However it does not apply to any recent estate. This means that any portion of an estate that was over the exemption rate was taxed at 40.

Connecticut continues to phase in an increase to its estate exemption planning to match the federal exemption by 2023. No estate tax or inheritance tax. As of 2021 you can inherit up to 1170000000 tax free.

The rate threshold is the point at which the marginal estate tax rate kicks in. Michigan does not have an inheritance tax with one notable exception. An inheritance tax a capital gains tax and an estate tax.

What is Michigan tax on an inherited IRA. An inheritance tax return must be filed for the estates of any person who died before October 1 1993. Estate tax of 112 percent to 16 percent on estates above 4 million.

Michigan does not have an inheritance tax with one notable exception. There is no federal inheritance tax but there is a federal estate tax. City Business and Fiduciary Taxes Employer Withholding Tax.

Michigan also does not have a gift tax. Where do I mail the information related to Michigan Inheritance Tax. A copy of all inheritance tax orders on file with the Probate Court.

However as the exemption increases the minimum tax. I will be splitting it with my sisters. As of this writing Michigan no longer collects estate taxes and only collects inheritance taxes if legacies are received from a person that died on or before September 30.

Lansing MI 48922. Thus the maximum federal. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of.

Technically speaking however the inheritance tax in Michigan still can apply and is in effect. The top estate tax rate is 16 percent exemption. Prior to 2018 the Federal Estate Tax Exemption was 549 million for individuals and 1098 million for married couples.

When the owner begins payments the income he receives is taxed by the Internal Revenue Service IRS at his current tax rate. If you have questions about either the estate tax or inheritance tax call 517 636-4486. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from.

Thats because Michigans estate tax depended on a provision in. Does Michigan Have an Inheritance Tax or Estate Tax. Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019.

When you inherit an annuity the payments you. An inheritance tax is a tool that governments sometimes use to tax assets that. Some individual states have state estate tax laws but michigan does not.

After much uncertainty Congress stabilized the Federal Estate Tax also known as the death tax. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. Is there a contact phone number I can call.

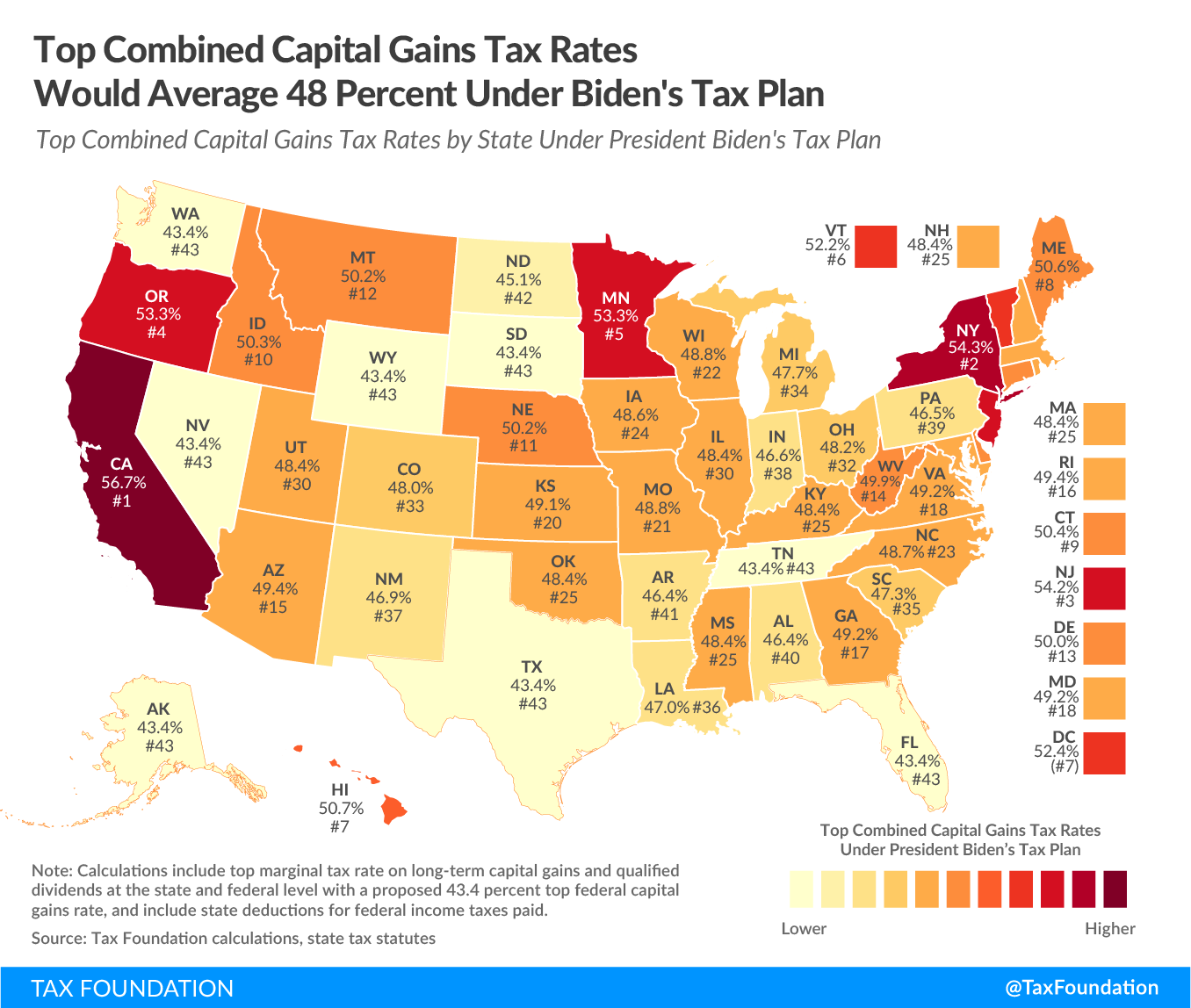

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

Ipoteka S Plohoj Kreditnoj Istoriej Pomosh Po Ipoteke Oformlenii I Poluchenii V Kazani I Po Tat Real Estate Investing Real Estate License Investment Property

Corporate Income Tax Definition Taxedu Tax Foundation

Frugal Retirees Ditch 4 Percent Rule Hoard Savings Instead Frugal Hoarding Retirement

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Michigan Estate Tax Everything You Need To Know Smartasset

Xl Property Management Llc Property Management Management Management Company

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Inheritance Tax Explained Rochester Law Center

Michigan Estate Tax Everything You Need To Know Smartasset

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Why Some Americans Should Still Wait To File Their 2020 Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

Examples Of Expansionary Monetary Policies Monetary Policy Financial Literacy Loan Money

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning